Mark Carney denied that the Bank of England undermined its

independence in the run-up to the U.K.’s referendum on its European

Union membership by highlighting the risks of a decision to leave.

“It’s

extraordinary, in all senses of the word,” the BoE governor responded

on Tuesday when asked by U.K. lawmakers about the charge that he shaped

the views of financial-stability officials. “That’s not the way the

committee works. The chair doesn’t guide conclusions.”

Before the June 23

vote, the BoE warned repeatedly that a decision to leave the EU would

create uncertainty that could weaken the pound, deter investment and

lead to a recession. Those comments were condemned at the time by

supporters of the “Leave” campaign, though Carney has since pointed out

that the risks identified have started to manifest.

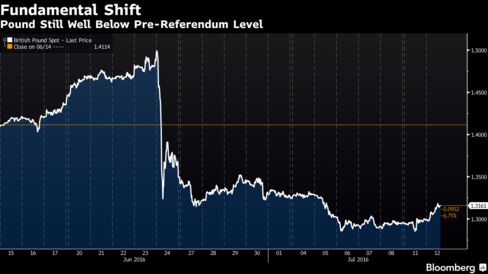

Sterling is

trading around $1.31, near a 31-year low and down from $1.50 just before

it became clear that the “Leave” campaign had won. By July 7, a total

of seven property funds with about 18 billion pounds ($24 billion) of

assets had frozen withdrawals as investors sought redemptions amid

concerns that international companies might scale back or shut London

operations, reducing the value of property.

Carney

declined to be drawn on the likelihood of monetary action, citing the

BoE’s quiet period before the next decision on Thursday. While the

nine-member Monetary Policy Committee won’t have substantial data on the

economic fallout from Brexit, officials may choose to act

pre-emptively. Thirty of 54 economists surveyed by Bloomberg predict the

benchmark interest rate will be lowered on July 14, with a majority of

those seeing a 25 basis-point reduction to 0.25 percent.

No Pressure

Testifying

alongside the governor in Parliament, external Financial Policy

Commitee members Richard Sharp and Donald Kohn said they weren’t

pressured to form certain views. Asked by Treasury Committee chairman

Andrew Tyrie whether the BOE was guilty of “startling dishonesty,” Sharp

replied “absolutely not” -- a position Carney backed.

“What’s in

the record, and the FSR, are the views of the FPC,” the governor said.

“They’re not pre-judged or pre-decided. They’re based on robust evidence

and discussion.”

Carney said he did talk with U.K. Chancellor of the

Exchequer George Osborne about the risks surrounding Brexit, and that

he’s prepared to look at ways of sharing details of those discussions

with lawmakers if it was in the public interest.

“I’d be wary of

establishing a precedent that limited free-flowing discussion between

future governors, future chancellors,” he told Tyrie. “We can create a

process which relies on the discretion of you as chair so that we are

not putting things in the public domain that could be immediately

sensitive.”

Political Leadership

Carney’s comments come after the publication of the record

of meetings of financial-stability officials held in the wake of the

vote. The FPC discussed the risk that cutting the countercyclical

capital buffer imposed on banks, freeing them to lend more, may instead

prompt the institutions to reward investors. The record reiterated a

readiness to take further measures if warranted.

The political

uncertainty in the U.K. may ease now that Home Secretary Theresa May is

on track to succeed David Cameron as prime minister on Wednesday. Her

only rival pulled out of the Conservative Party leadership contest,

speeding up the process by two months. May worked at the BOE from

1977-83 in the economics area in the central bank’s

financial-institutions and monetary-policy groups.

Still, the

questions about Britain’s future trade status with Europe and the rest

of the world may take months or years to settle and could hamper

investment and hiring decisions, Carney said.

“The

financial-stability risks have been more immediate,” he told lawmakers.

“Longer term, the underlying performance of the economy is one of the

key determinants of financial stability and the decisions that

Parliament will take in coming years will be hugely important in

determining that trajectory.”

While the uncertainty may mean there

is less foreign direct investment in Britain than there would otherwise

have been, the British economy should continue to grow in the longer

term and the decline in the pound will make sterling assets more

attractive to overseas investors, Carney said. “We’re seeing increases,

but not sharp increases in risk premia in the U.K.”

The

pound’s drop could also help narrow the current-account deficit. If

sterling stays at present levels, the gap could shrink by about a third,

he said. The BOE has warned the shortfall, large historically and

compared with other nations, is a source of vulnerability.

Liquidity Operations

BoE

financial-stability officials also published a redacted portion of text

from their March meeting, which shows they received briefings on the

central bank’s contingency plans, which included “managing funding and

liquidity risks in sterling and foreign currency.”

Carney has

increased the number of the BoE’s liquidity operations since the vote to

leave the EU. At an auction of funds in exchange for collateral on

Tuesday, banks were allotted 2.01 billion pounds, compared with 3.1

billion pounds at an operation in the days following the vote and 1.35

billion pounds last week.

The governor said the BoE’s comments and

actions before and since the referendum, with multiple public

appearances, show the institution has become far more open about its

intentions. He hit back at lawmaker Jacob Rees-Mogg, a Brexit supporter

who is one of his most prominent critics, who said there had been a

“lack of appearance of impartiality” by the BoE.

“The BoE and the

Financial Policy Committee are well aware of their statutory

responsibilities,” Carney said. “I think those who cast it into question

should consider their motivations and their judgment."

http://www.bloomberg.com/news/articles/2016-07-12/boe-discussed-risks-of-lowering-banks-buffers-post-brexit

No comments:

Post a Comment