One consequence of Brexit could be that more London properties end up in foreign hands.

That's

the ironic product of Britain's decision to exit the European Union —

an outcome predicated in part on a desire to reduce immigration to the

U.K.

Investors pulling money from

U.K. property funds out of fear that real estate values will fall are

forcing sales of prime properties in London. The managers of seven

funds with about 18 billion pounds ($23.7 billion) of property suspended

trading last week as investors rushed to redeem, and some are now

offloading key holdings.

For certain investors, the timing couldn't be better. With the pound hovering near its weakest levels since the mid-1980s, the purchasing power of overseas investors in the U.K. has risen at exactly the time when Brexit jitters are helping to expand the pool of properties available to buy.

For certain investors, the timing couldn't be better. With the pound hovering near its weakest levels since the mid-1980s, the purchasing power of overseas investors in the U.K. has risen at exactly the time when Brexit jitters are helping to expand the pool of properties available to buy.

Aberdeen

Asset Management Plc has hired a broker to sell an office building in

the Hammersmith district of West London, and it is also reportedly working

on the sale of a retail store on Oxford Street, Europe's

busiest shopping thoroughfare. Meanwhile, Henderson Global Investors is

believed to be planning

to dispose of the Headquarters of Coutts & Co., bankers to the

British royals, that's located on the Strand, a stone's throw from

Buckingham Palace.

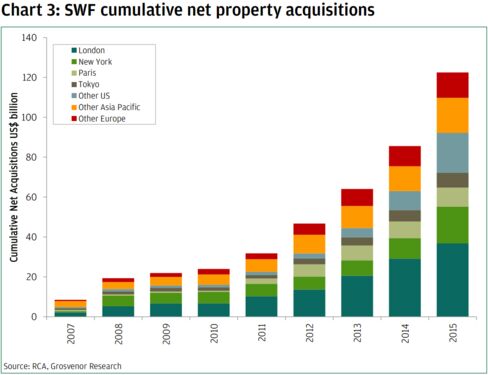

Similar sales in recent years would have drawn

strong demand from overseas buyers, including sovereign wealth funds,

seeking to diversify their portfolios as yields on bonds decline. And

while Brexit has rattled the real-estate sector, sterling at a 30-year

low offers a compelling reason to think demand for the best assets will

stay strong.

Indeed, just last week Swedish billionaire Stefan Persson reportedly agreed to buy retailer Debenhams Plc’s flagship store on Oxford Street.

"The

slowdown of foreign investments in to London CRE in the run-up to the

referendum started and many investments seems to have been put on ice

for the time being," said Bank of America Corp. analysts led by

Alexander Batchvarov, using the acronym for commercial property. "Having

said that there seems to be always demand for trophy properties as the

recent sale of an Oxford Street retail space proved."

http://www.bloomberg.com/news/articles/2016-07-12/brexit-could-help-foreigners-buy-up-more-of-london

No comments:

Post a Comment