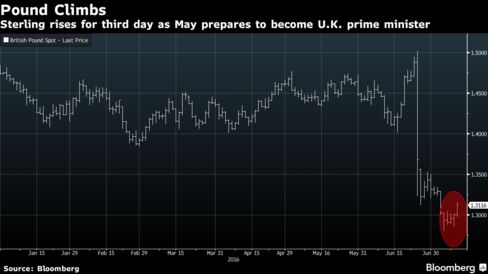

The pound climbed the most since three days before Britain’s European

Union referendum as Home Secretary Theresa May prepared to take over as

the U.K.’s next prime minister, removing one layer of political

uncertainty.

Sterling rose to its highest level in a week versus

the dollar as investors digested the implications of the new premiership

on the U.K.’s negotiations with the EU over its withdrawal from the

bloc. May is poised to take office

by Wednesday night London time, replacing David Cameron after her only

rival pulled out of the Conservative leadership contest Monday. The FTSE

100 Index of shares touched an 11-month high.

“Now

the way is clear for May” to apply for an exit from the EU, said Thu

Lan Nguyen, a currency strategist at Commerzbank AG in Frankfurt. “There

may be hopes that the whole process of uncertainty will be shortened.”

The

pound rose 1.4 percent, the most since June 20, to $1.3185 as of 4:10

p.m. in London, having earlier touched $1.3190. The U.K. currency fell

to a 31-year low of $1.2798 on July 6. Sterling strengthened for a

fourth day against the euro, appreciating 1.4 percent to 83.93 pence.

The

pound’s recovery this week has barely dented its drop since the June 23

referendum. Sterling reached $1.50 in the aftermath of the vote, amid

speculation the “Remain” camp would triumph, before falling the most on

record as it became clear “Leave” would win. Speculation is also

building that Bank of England policy makers will cut interest rates in

an effort to spur growth amid signs the decision to leave the world’s

biggest trading bloc shook confidence in the economy.

There “seems

to be a notion that less political uncertainty is lowering the risk of

the BoE turning more aggressive,” said Manuel Oliveri, a currency

strategist at Credit Agricole SA’s corporate and investment-banking unit

in London. “But this remains to be seen.”

BoE Outlook

In a testimony to Parliament’s Treasury committee, BoE Governor Mark Carney defended

the institution against criticism that it undermined its independence

by highlighting the risks of a Brexit. The central bank will announce

Thursday its first policy decision since the historic vote.

Futures

pricing shows the chances of a rate cut by the BoE this week have

climbed to 80 percent, compared with 11 percent on the day of the EU

referendum.

U.K. government bonds fell, with benchmark 10-year

gilt yields rising six basis points, or 0.06 percentage point, to 0.82

percent. The yield dropped to an all-time low of 0.708 percent Monday.

The

current level of gilt yields “would suggest 30 years of stagnation,”

Carney said in testimony to U.K. lawmakers. “But I would underscore that

what is happening in markets, there’s a big element which is in our

opinion, my opinion, a hedging of downside risk.”

http://www.bloomberg.com/news/articles/2016-07-12/pound-climbs-for-third-day-as-may-prepares-to-take-office

No comments:

Post a Comment